Irs Tax Refund Calendar 2026 Release Date Spectacular Breathtaking Splendid. It is essential to file taxes early to expedite the refund process. To ensure you get your 2026 tax refund on time, it’s crucial to be aware of the key dates in the tax refund schedule.

Tax day for the year 2026 is celebrated/ observed on wednesday, april 15. What is the tax refund schedule for 2026?the irs has not released the official tax refund schedule for 2026 yet. Tax day is april 15th of each year (unless changed by federal government for that year) and marks the final day to file your income tax returns with the internal revenue service (irs).

Source: deloraaseemmalee.pages.dev

Source: deloraaseemmalee.pages.dev

Irs Calender Vevay Julissa Additionally, the irs issues refunds in batches once they have processed the tax returns. Are you eagerly waiting for your irs tax refund in 2026?

Source: glass-tax.com

Source: glass-tax.com

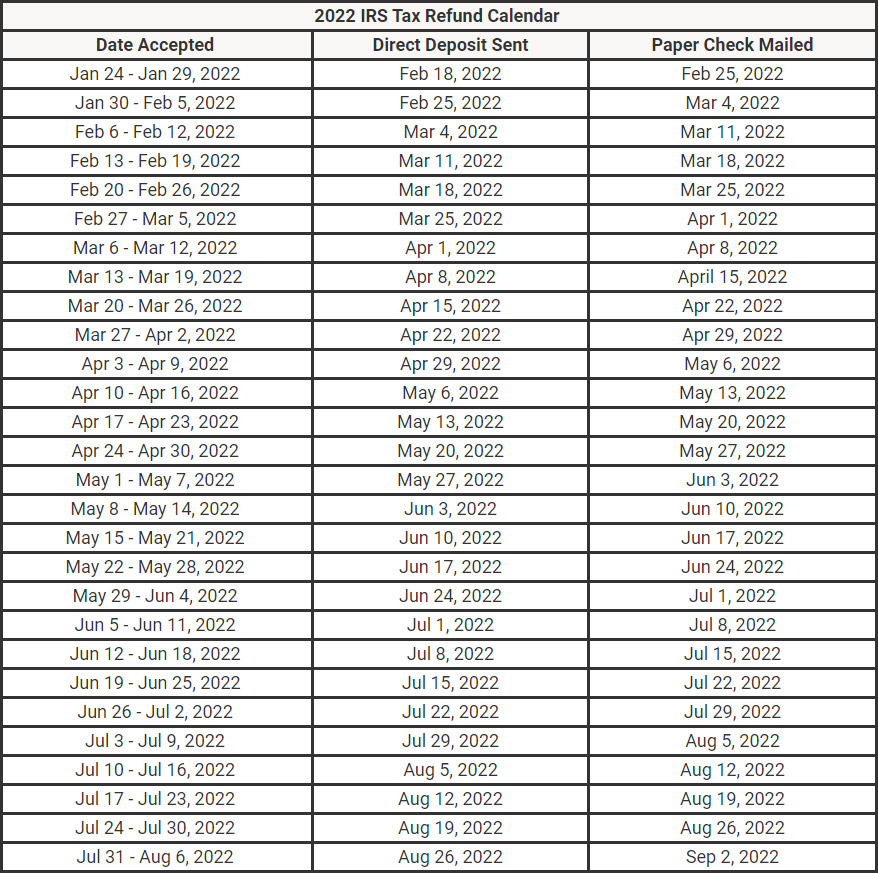

When To Expect My Tax Refund? The IRS Tax Refund Calendar 2022 GLASS Tax day is april 15th of each year (unless changed by federal government for that year) and marks the final day to file your income tax returns with the internal revenue service (irs). It is essential to file taxes early to expedite the refund process.

Source: monthlymarketingcontentcalendar.pages.dev

Source: monthlymarketingcontentcalendar.pages.dev

Tax Refund Schedule 2024 Irs Calendar Utd Fall 2024 Calendar Tax day for the year 2026 is celebrated/ observed on wednesday, april 15. Are you eagerly waiting for your irs tax refund in 2026?

Source: schedule2026.com

Source: schedule2026.com

Unlocking the IRS Refund Schedule 2026 What You Need to Know It is essential to file taxes early to expedite the refund process. For the irs refund schedule 2026, the key dates to keep in mind are the start of tax season, which typically begins in january, and the deadline for filing taxes, usually on april 15th.

Source: www.upexciseportal.in

Source: www.upexciseportal.in

IRS Tax Refund Schedule for 2025 Important Dates You Need to Navigating the process can sometimes be overwhelming, but with the right information, you can stay informed and prepared. Tax day for the year 2026 is celebrated/ observed on wednesday, april 15.

2025 IRS Tax Refund Calendar And Schedule (Updated) Are you eagerly waiting for your irs tax refund in 2026? For the irs refund schedule 2026, the key dates to keep in mind are the start of tax season, which typically begins in january, and the deadline for filing taxes, usually on april 15th.

Source: arturowhonore.pages.dev

Source: arturowhonore.pages.dev

Irs Tax Return Calendar Arturo W. Honore As you plan your finances for 2026 and await your irs refund, it’s essential to mark key dates on your calendar. It is essential to file taxes early to expedite the refund process.

Source: johnxpatel.pages.dev

Source: johnxpatel.pages.dev

Irs Tax Deposit Dates 2025 John X Patel The 2026 tax refund schedule chart provides a comprehensive guide on when taxpayers can expect to receive their tax. Additionally, the irs issues refunds in batches once they have processed the tax returns.

Source: pelhamplus.com

Source: pelhamplus.com

IRS Refund Schedule 2024 Know The Date Of Release Of Your Federal Tax It is essential to file taxes early to expedite the refund process. Navigating the process can sometimes be overwhelming, but with the right information, you can stay informed and prepared.

Source: elnoratherine.pages.dev

Source: elnoratherine.pages.dev

Irs Check Release Dates 2025 Elly Allyson Tax day is april 15th of each year (unless changed by federal government for that year) and marks the final day to file your income tax returns with the internal revenue service (irs). Additionally, the irs issues refunds in batches once they have processed the tax returns.

Source: keralacobank.com

Source: keralacobank.com

IRS Tax Refund Schedule 2025 When Will You Get your Checks Understanding the irs tax refund schedule 2026 is crucial to plan your finances effectively. For the irs refund schedule 2026, the key dates to keep in mind are the start of tax season, which typically begins in january, and the deadline for filing taxes, usually on april 15th.

Source: malexmorris.pages.dev

Source: malexmorris.pages.dev

2025 Tax Refund Calendar Release Date M Alex Morris It is essential to file taxes early to expedite the refund process. Navigating the process can sometimes be overwhelming, but with the right information, you can stay informed and prepared.